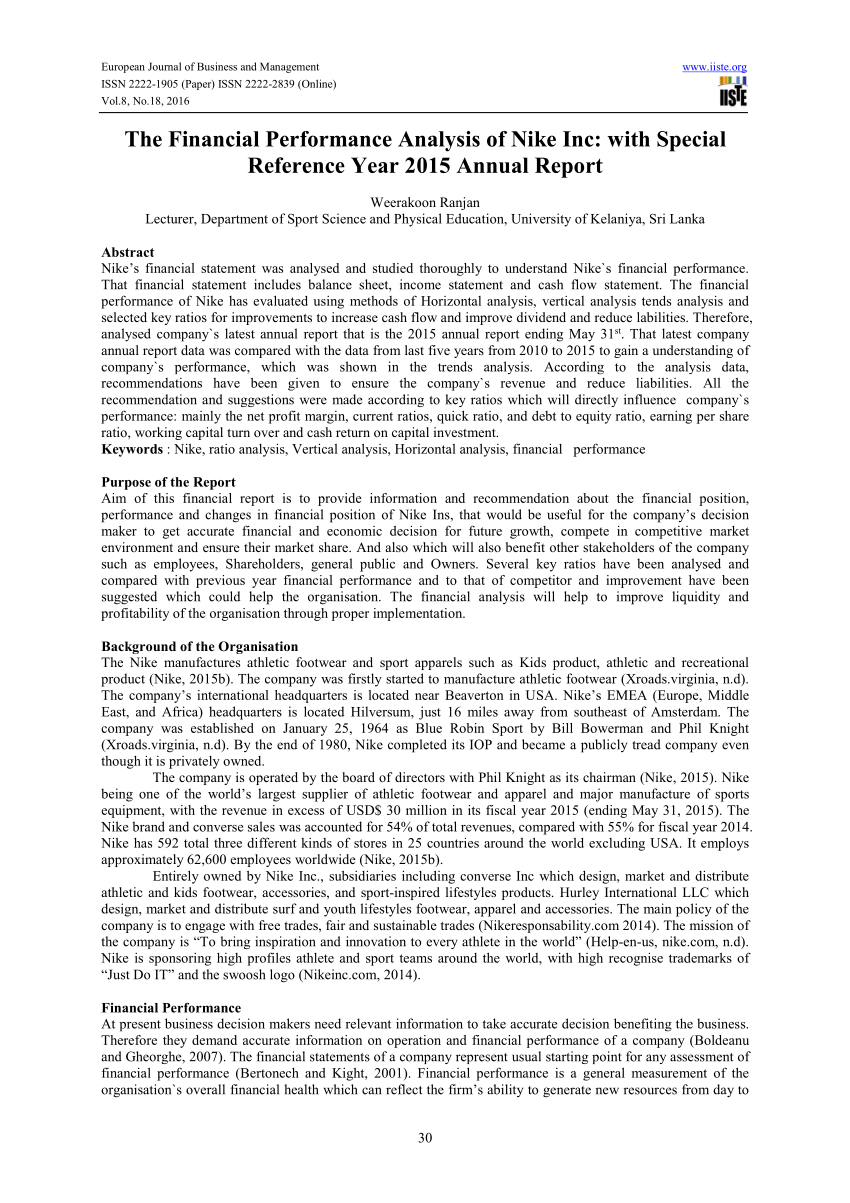

Nike, Inc COPYRIGHT ©2007 Thomson South-Western, a part of the Thomson Corporation. Thomson, the Star logo, and South-Western are trademarks used. - ppt download

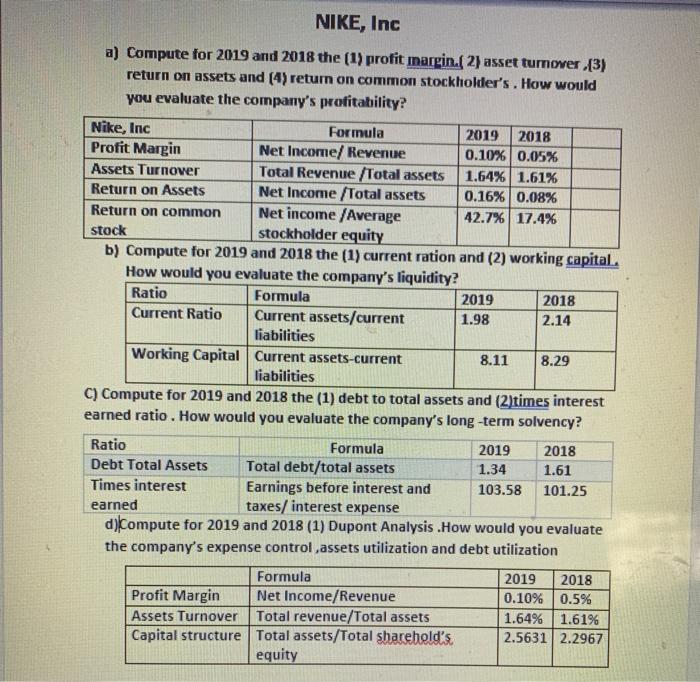

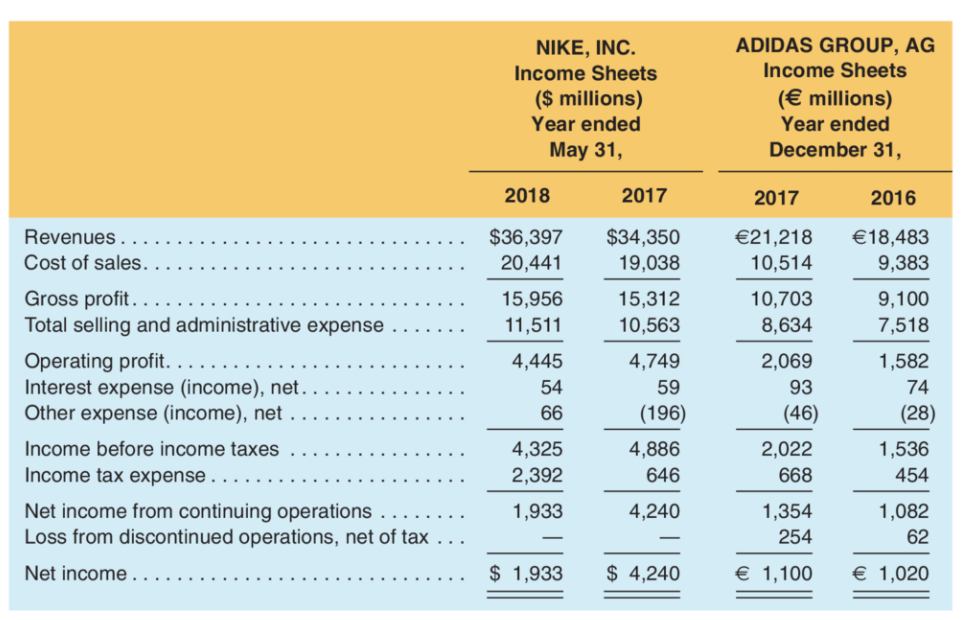

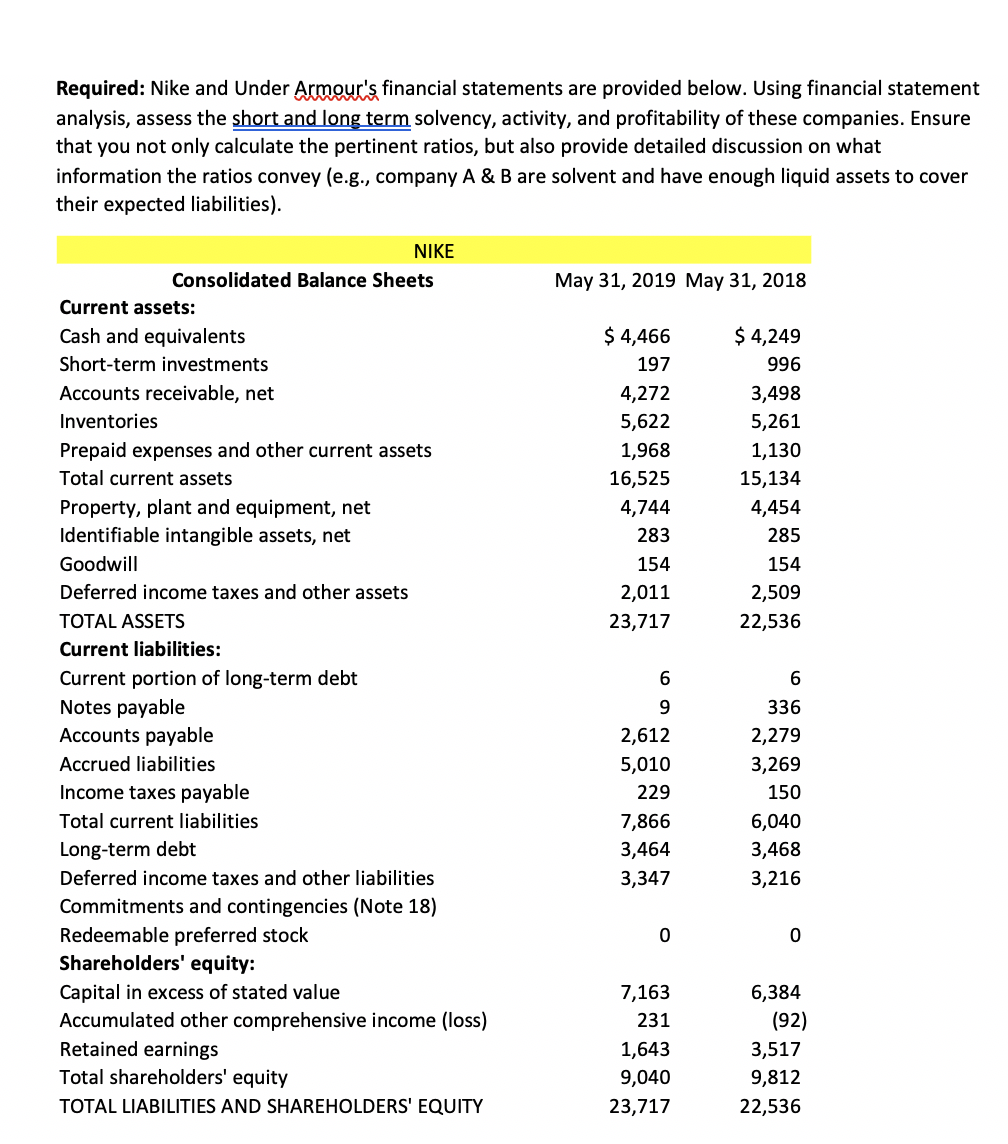

Nike, Inc Daniel Cibran ACG. Daniel Cibran ACG Annual Report Project Directions : Annual Report Project Directions : DURING THE CLASS. - ppt download

:max_bytes(150000):strip_icc()/GettyImages-1152522435-5e7fb93156e3488281174dbfd0bc70bc.jpg)

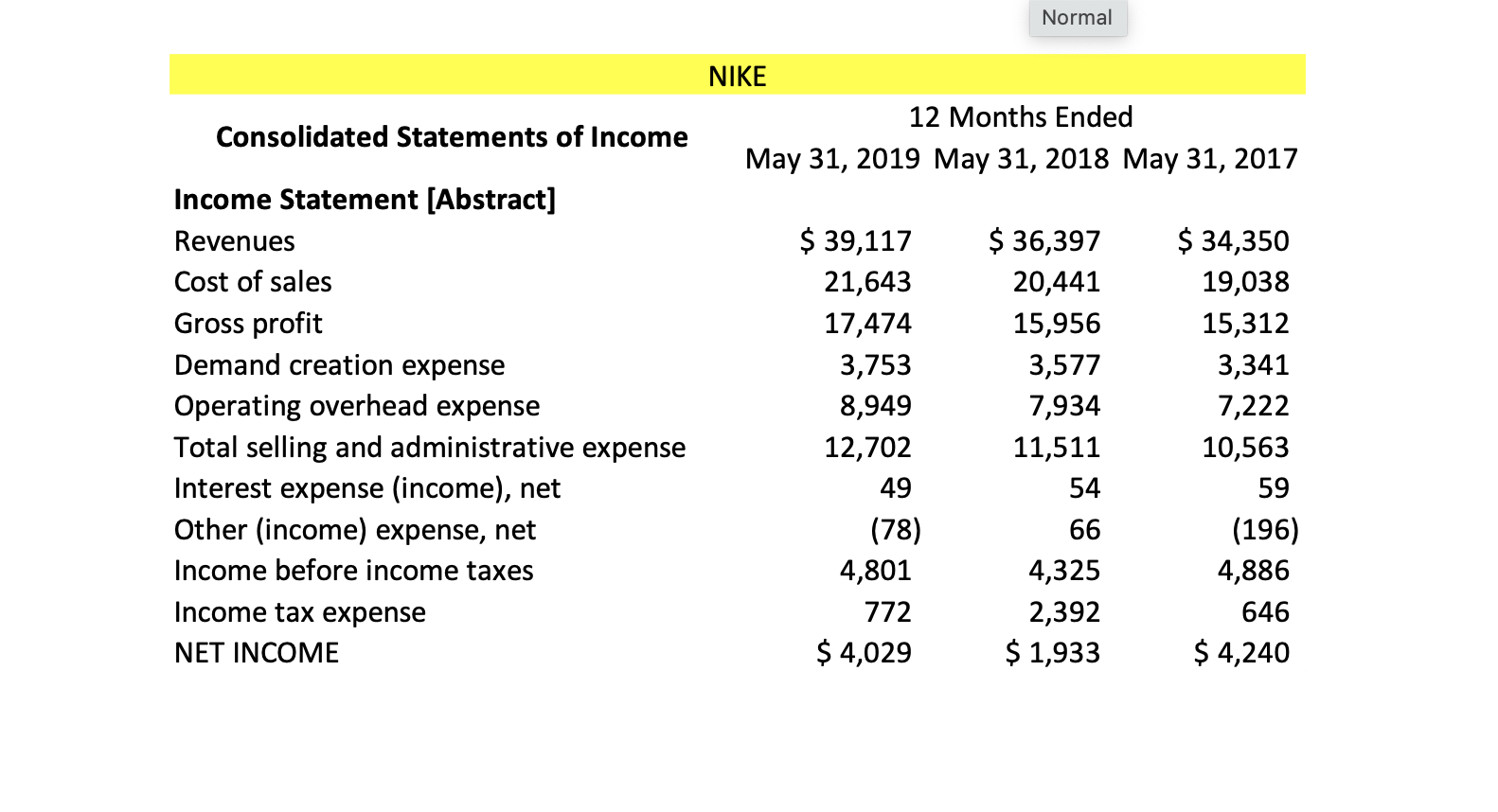

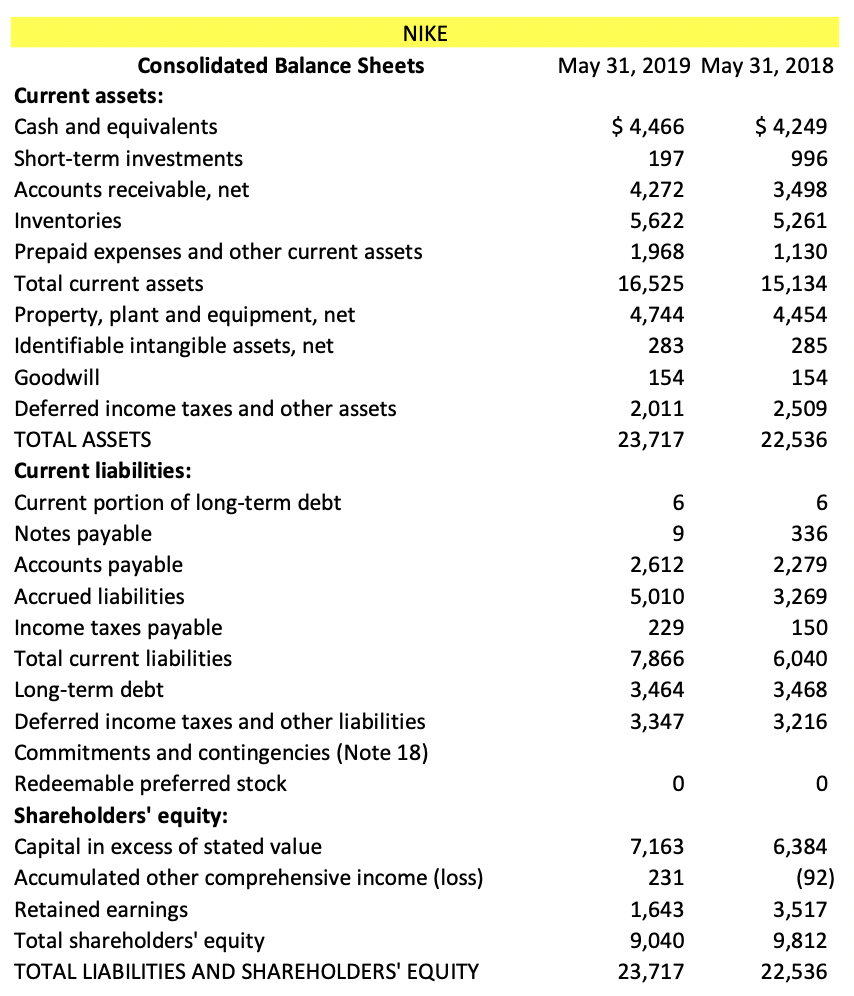

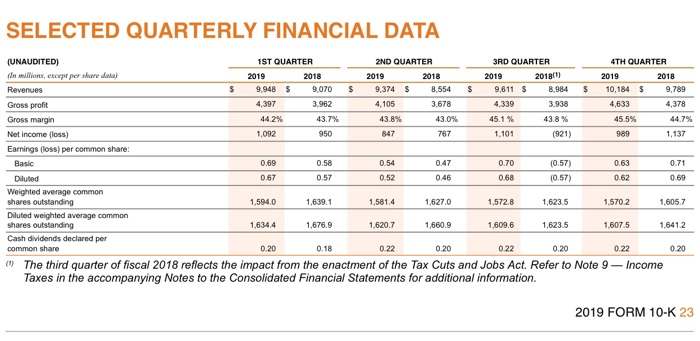

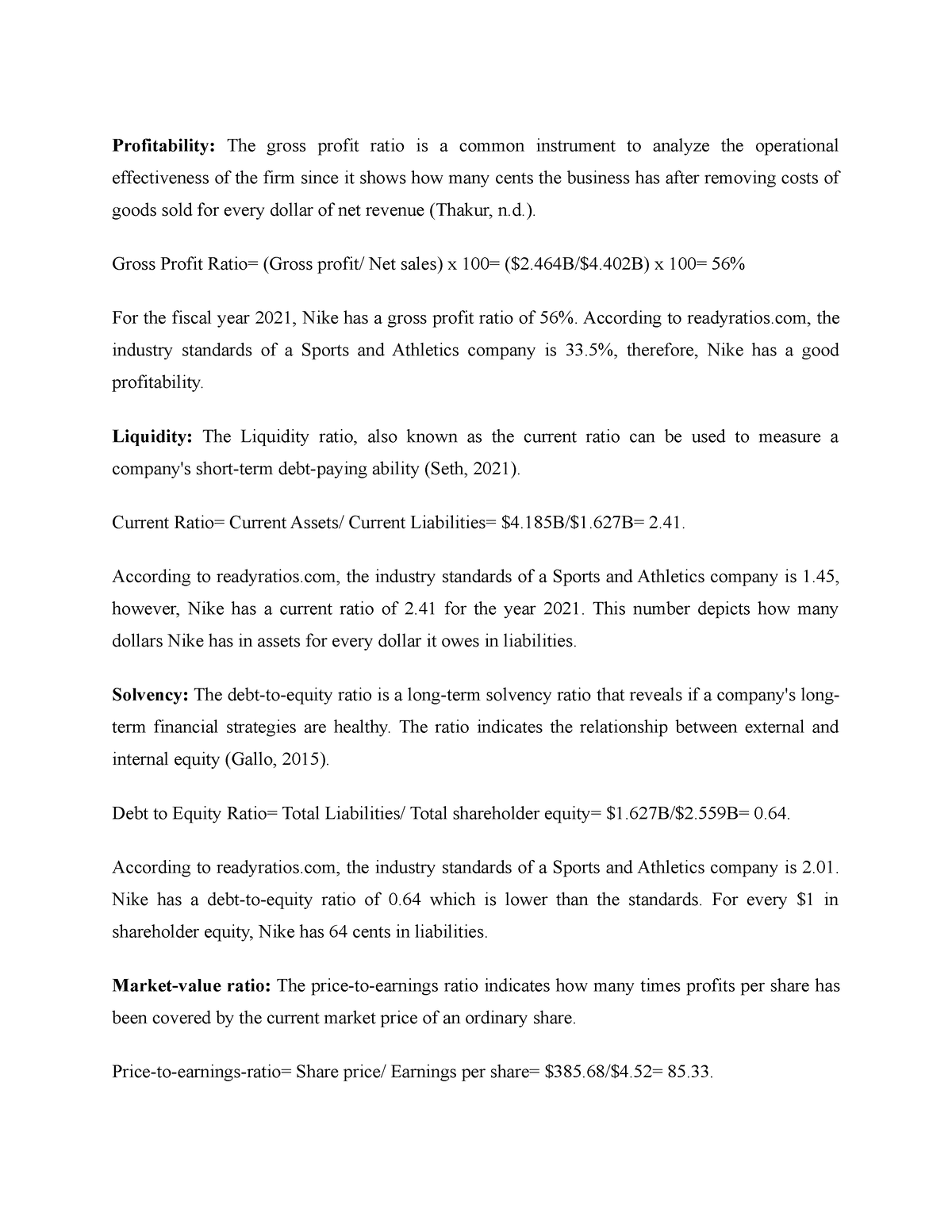

:max_bytes(150000):strip_icc()/TermDefinitions_Debt-to-CapitalRatio-c25b169207f64c2d8759194ba8be3aa9.jpg)